Editor’s note: This story was updated December 17, 2020, to reflect the most current information.

Though December 31 is closing in fast, contractors still have time to purchase construction equipment and write off 100 percent of the cost of that purchase on their 2020 taxes as depreciation or a Section 179 tax deduction.

Section 179 covers not only new equipment, but used as well, thanks to a change in the tax law in late 2017. The law also increased first-year bonus depreciation to 100 percent and included used equipment; before that, only new equipment qualified.

Knowing contractors are now looking at tax implications of equipment buys, construction equipment manufacturers are rolling out sales and incentives, touting Section 179 and bonus depreciation to entice purchases before the year ends. But they also note that contractors should first check with their accountants.

Accountants agree Section 179 and bonus depreciation are excellent benefits for contractors in the market for new or used equipment – if the purchase makes business sense. But contractors, especially those starting out in business and those with income losses, should be aware of some pitfalls before pulling the trigger on an equipment purchase with tax benefits in mind.

What’s new for 2020?

The main change in the benefit for this year is an inflationary increase, which was another new provision in the Tax Cuts and Job Acts of 2017.

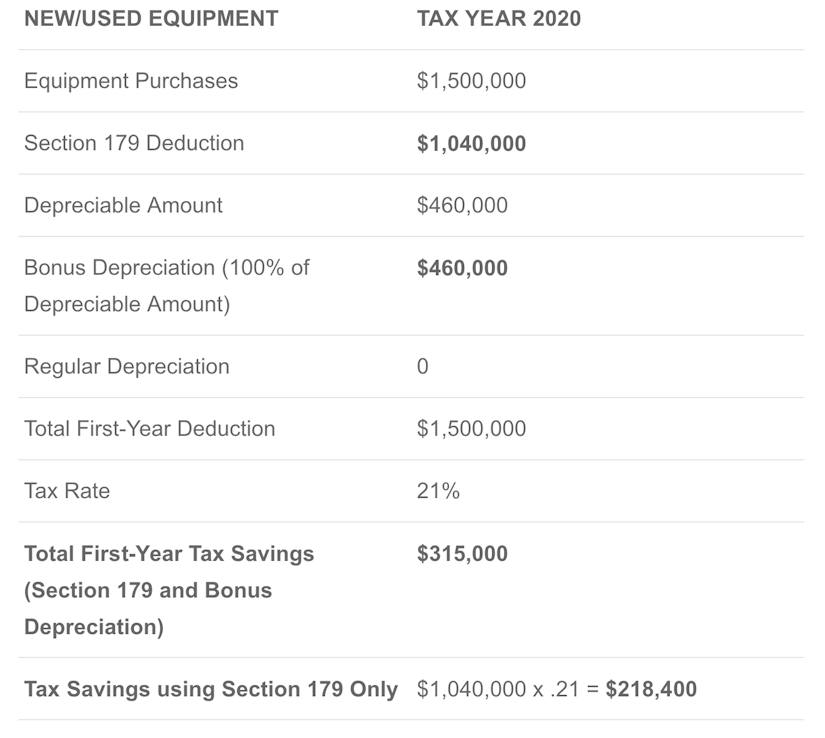

That means the maximum Section 179 expense that can be deducted for equipment has risen $20,000 to $1,040,000 for 2020.

The cap on the amount of equipment purchased to take the full benefit has also risen, by $40,000 to $2.59 million. Once the $2.59 million cap is reached, the benefit gradually phases out until reaching $3,630,000.

Bonus depreciation for 2020 is again 100 percent and again has no cap, same as in 2019.

The deductions are not affected by any government coronavirus relief funds, such as the Paycheck Protection Program, contractors may have received during the year.

Chris Fletcher

Section 179 can also be taken if the equipment is leased or purchased, notes Chris Fletcher, vice president of national accounts at Crest Capital. “In fact, many companies like doing this because the tax money saved almost always exceeds the payments they made during the calendar year,” he says.

Equipment also includes office machines, furniture, computers and software, safety equipment, and vehicles with more than 6,000 pounds of gross vehicle weight. Eligible equipment could also include coronavirus-related purchases.

“If you needed to buy equipment to modify your workspace for Covid-19, such as plexiglass dividers, air filtration systems, sanitizing stations, new servers for work-at-home people, etc., it’s very likely they are Section 179 eligible,” Fletcher says.

How it works

Along with the caps, Section 179 and bonus depreciation differ when there’s an income loss.

Section 179 is limited to taxable income.

For instance, if your 2020 taxable income was $100,000 and you purchased a $200,000 piece of equipment, you could only deduct up to $100,000 in the first year. And if you had a net loss, you would not be eligible for Section 179. However, you could carry forward Section 179 to the next year and so on, according to CPA Keith Hollar, tax partner with Calvetti Ferguson in Fort Worth, Texas.

Keith Hollar

Or you could take the first-year bonus depreciation, which does not face such limitations. It can even be taken if the company experiences a loss in net income.

“We’ve seen that come into play,” Hollar says. “Maybe somebody is starting up or they’re in the beginning stages of an operation. If they want to go ahead and take the bonus to get the benefit, they can carry that net operating loss forward. That will help offset some of their next year’s revenue when they move into the second year and they’ve got more revenue and potential net income.”

For companies with sufficient net income, Section 179 is usually taken first. And if they reach the cap, bonus depreciation can follow.

This year also brings some new tax considerations to the table, in which a discussion with an accountant could affect your decisions. To read more about the new tax changes contractors can benefit from in 2020, click here.

Volvo Construction Equipment presents the following example to show how contractors in such situations can benefit:

How much time to buy?

Equipment purchases made before the end of the year qualify for Section 179 and bonus depreciation on 2020 taxes as long as the equipment is put into service by midnight December 31.

The law does not stipulate a set amount of time the equipment must be in service, Hollar says.

“As long as you put it in service,” according to Hollar, it qualifies.

Used equipment purchases do have a few more rules for Section 179 and bonus depreciation. For one thing, the used equipment must be “new” to the purchaser. And it can’t be equipment previously owned by a related business entity or relative.

Contractors should also remember that these tax benefits won’t end in 2020, so if you can’t squeeze in a purchase within the remainder of the year, there’s always next year and a few more after that.

Section 179 is a permanent benefit, under the law. The 100 percent bonus depreciation begins to phase out in 2023, when it drops to 80 percent. It falls another 20 percent each year after that until reaching zero starting January 1, 2027.

It should also be noted that in 2021, the inflationary increase written into the law will rise to $1.05 million for the Section 179 deduction amount, and the cap will rise to $2.62 million.

Pitfalls

“You shouldn’t just buy something just to get a deduction,” says Hollar. “Is this a piece of equipment that you really need to do a project or process or procedure quicker, better, faster or maybe go into a new line of production or a new line of business?”

Chris Cicalese

CPA Chris Cicalese, manager at Alloy Silverstein in Cherry Hill, New Jersey, also notes that 100 percent depreciation in the first year prevents depreciation of that equipment in future years. The eventual phase-out of 100 percent bonus depreciation in future years is something else to consider.

“It is more important to discuss how to use the depreciation provisions along with any other provisions, such as the Qualified Business Income Deduction, with your CPA to take advantage of what is available now and speculated to not be available in the future,” Cicalese says.

Contractors should also be aware of the Section 179 and bonus depreciation rules for the states they operate in. Not all states followed the federal tax changes.

Is it worth the rush?

So should you hurry to buy equipment before the end of the year?

Again, the answer comes down to another question: Does it make business sense?

“If it’s something they can place in service, get going and it makes business sense for them, it’s certainly a good tax-saving option,” Hollar says.

Cicalese adds, “Although the tax law change can provide a more favorable result, it is my experience that taxpayers don’t necessarily go out of their way to buy assets that weren’t essential in their day-to-day just because of the new 179 or bonus depreciation rules.”