Rouse: Excavator auction values have shown continued declines.

At mid-year, some sectors are showing a softening in used equipment prices while others remain flat, according to the June 2019 The Equipment Report by Rouse Services. Rouse says general construction equipment values have remained relatively flat while heavy earthmoving equipment is “showing overall underperformance” in both retail and auction prices.

Source: Rouse Services

General construction sector

Rouse reported the following equipment type performances in its general construction sector:

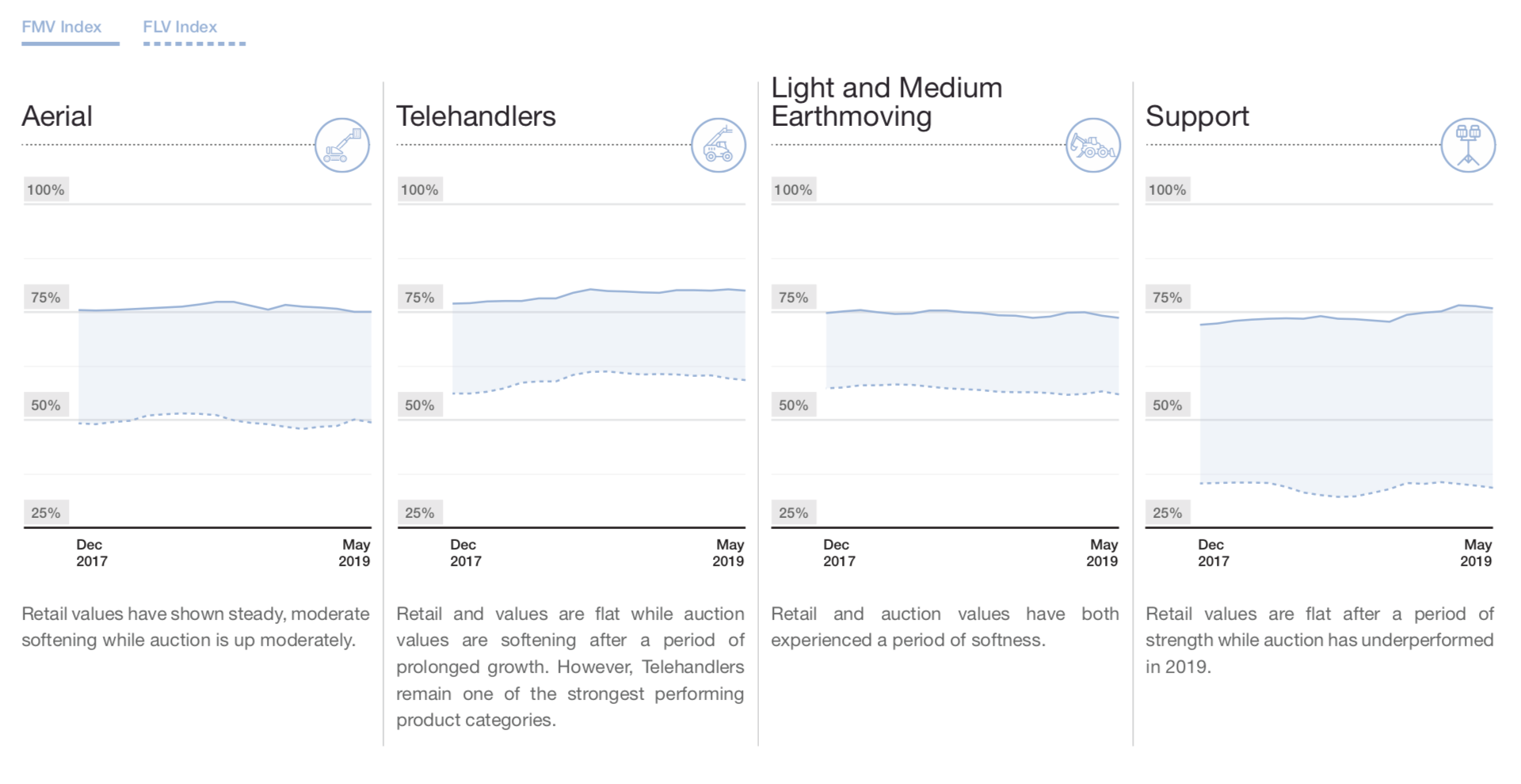

Aerial lift equipment: Retail values have show a steady, moderate softening while auction prices are moderately up. (Includes scissor lifts and telescopic and articulating boom lifts.)

Telehandlers: After a period of prolonged growth, retail values are flat and auction prices are softening. As an equipment type, however, telehandlers remain one of the strongest performing product categories.

Light and medium earthmoving: Retail and auction values have both experienced a period of softness. (Includes backhoes, under-180-horsepower dozers, under 75,000-pound excavators, skid steers, compact track loaders and under 190-horsepower wheel loaders.)

Support: Retail values are flat after a period of strength, while auction prices have underperformed this year. (Includes air compressors, generators, HVAC and lighting equipment.)

Source: Rouse Services

Heavy earthmoving sector

In its heavy earthmoving equipment sector, Rouse reported the following:

Excavators: Retail values have flattened after a down performance, and auction values have shown continued declines.

Dozers: Retail values ticked up while auction values flattened.

Wheel loaders: Retail values are fairly flat while auction values dipped after a prolonged period of moderate growth.

Articulated trucks: Both retail and auction values have dipped in the recent period.

Rouse Services tracks used equipment values using two primary methods: collecting prices reported publicly by auction companies, and compiling proprietary used equipment transaction prices reported by its established network of clients – this network includes national, regional and independent rental operations and OEM dealers. Rouse estimates that 70 percent of the RER Top 100 firms are in this reporting network. In reporting these numbers, Rouse uses the terms Forced Liquidation Value (FLV) for auction prices, and Fair Market Value (FMV) for retail prices.

Rouse Services has three divisions. Rouse Appraisals provides equipment evaluations to rental companies, construction equipment dealers and their investors. The firm says that on an annual basis it values approximately $40 billion of equipment, tracks more than 30,000 unique makes and models and analyzes nearly $10 billion of retail, auction and trade-in sales of used equipment. Rouse Sales helps rental companies and fleet owners optimize their used equipment selling programs. Rouse Analytics collects information on more than $20 billion in rental invoices per year and more than $50 billion of fleet from more than 150 participating rental companies and dealers.