High demand and unexpected increases in dealer restocking led to a 14% increase in sales and revenue in the first quarter of 2022 for Caterpillar.

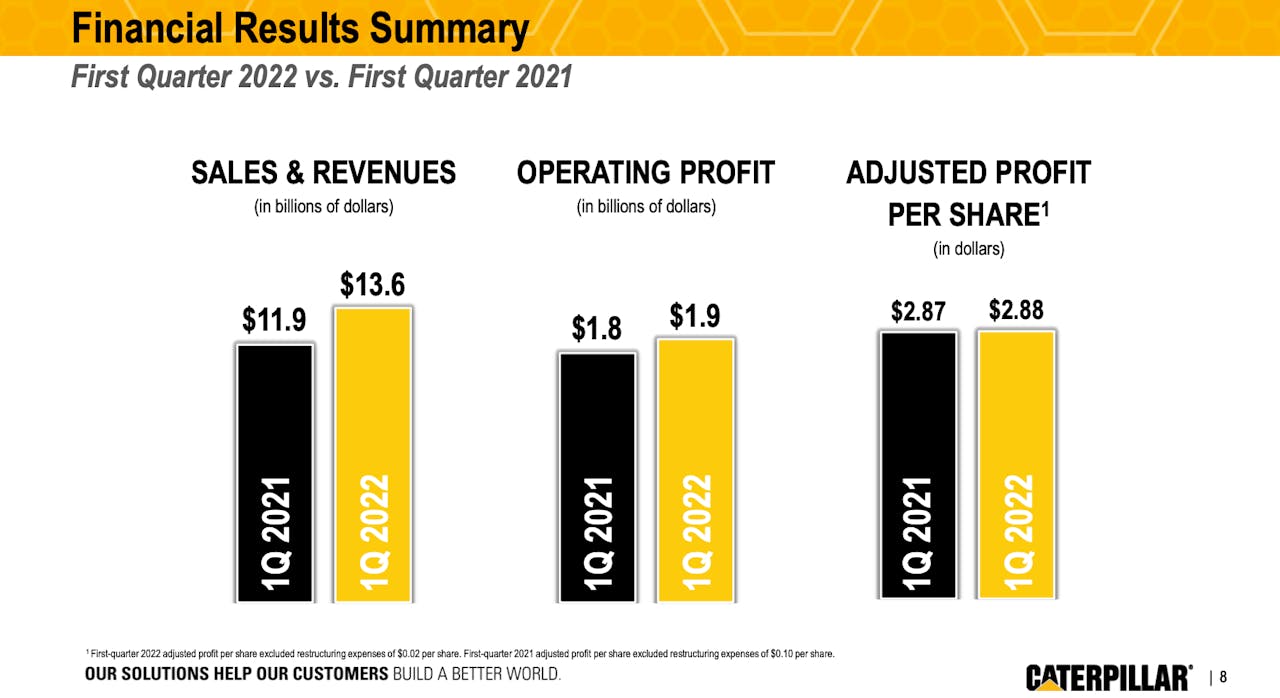

The company announced sales and revenue of $13.6 billion for Q1 2022 compared to $11.9 billion in the same period of 2021. It marked the fifth consecutive quarter of higher end-user demand compared to the prior year. Sales increased across all of Cat’s primary segments (construction industries, resources industries, and energy and transportation) due to volume gains and favorable prices.

“We continue to be encouraged by strong order demand across our segments in the first quarter of 2022,” said Jim Umpleby, Caterpillar chairman and CEO.

The unexpected sales increase occurred from the dealers increasing their inventories by about $1.3 billion, nearly double what Cat had anticipated and about $600 million more than in Q1 of 2021. Dealer inventories had reportedly remained relatively flat in 2021 after a $2.9 billion decline in 2020.

“About half of that $600 million increase yea on year came from resource industries due to the timing of shipments from dealers to their customers, which can be lumpy,” said Andrew Bonfield, Caterpillar chief financial officer. “These units are backed by firm customer orders who were not recognized in our reported retail sales for the quarter.” He said this is due in part to variations in onsite assembly times. The CFO said the remaining half of the field inventory increase was mainly due to timing in shipments in the construction industry late in the quarter.

“We anticipate the dealers will start to sell down the inventories in the second quarter following their normal seasonal pattern and strong sales to users,” Bonfield said, noting that Cat’s expectations for the full year have not changed and the company does not expect to see a significant benefit from dealer restocking in 2022 as end-user demand remains strong.

“While dealer inventories remained near the low end of the typical range, we continue to work closely with them to satisfy higher end-user demand,” added Umpleby.

Per the report, Cat’s total backlog increased by $3.4 billion as the company experienced continued strong demand and supply chain challenges.

“The environment continues to be challenging due to supply chain constraints and the more recent COVID 19 related shutdowns in China,” Umpleby said. “Although manufacturing costs are expected to remain elevated, we expect price to more than offset these costs increases for the full year.”

He praised the global team’s performance in achieving double-digit sales growth despite the supply chain challenges. Umpleby acknowledged that the top line would have been stronger without the supply chain constraints, which were like those highlighted in the Q4 report of 2021.

“We continue to experience constraints with semiconductors and certain other components,” said Umpleby. “Our team continues to implement solutions to help mitigate the overall situation.” Cat has executed engineering redesigns to provide customers with alternative options and increased dual sourcing of components and placed specialized Caterpillar resources and suppliers to help ease constraints.

“When the supply chain conditions ease, we expect to be well positioned to fully meet demand and gain operating leverage from higher volume. Overall, we remain encouraged by the strong demand for our products and services, and we remain focused on supporting our customers and executing our strategy for long-term profitable growth.”

Construction sales

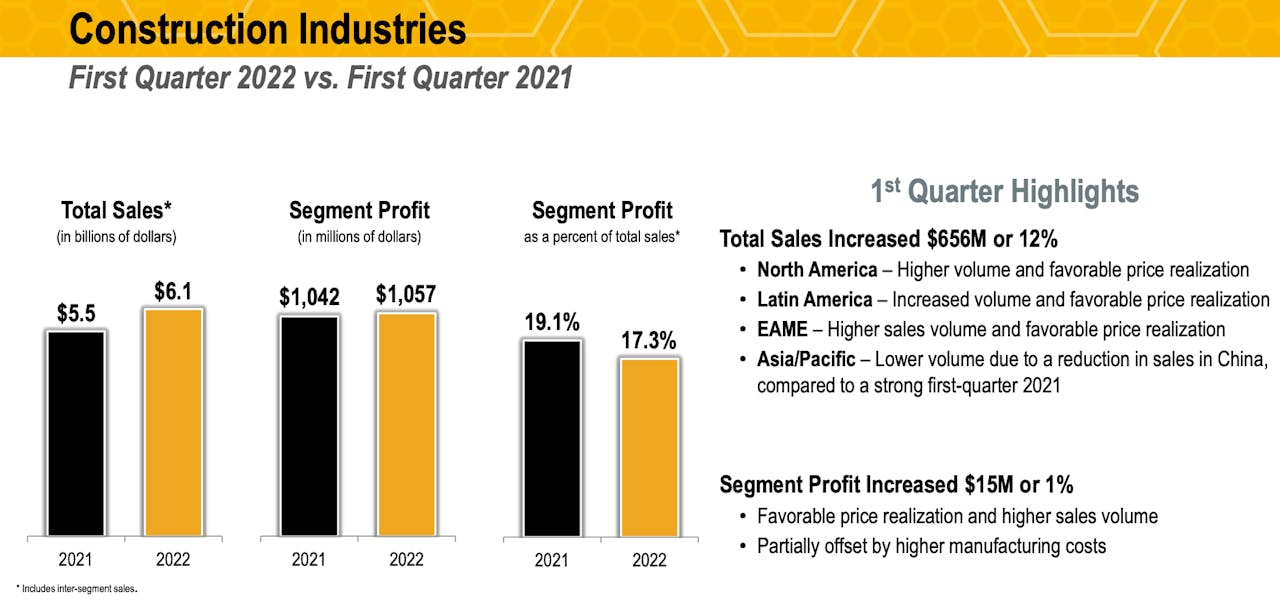

Within construction industries specifically, Andrew Bonfield, Cat’s chief financial officer, said sales increased 12% in Q1 to $6.1 billion, primarily driven by federal price realization and strong sales volumes. End-user demand improved in three of four regions. He said the segment’s first quarter profit increased by 1% versus the prior year to $1.1 billion.

“Price realization and a higher sales volume drives increase more than offsetting increases in manufacturing costs,” Bonfield said. “Price realization was stronger than we had anticipated but lagged manufacturing costs in the quarter.” He noted the segment’s operating margin decreased by 180 basis points to 17.3%.

According to the report, the North America region had the highest sales growth and sales dollars with a 28% increase as non-residential demand improved, and residential construction remained strong. “Despite rising interest rates, infrastructure investment is expected to improve in late 2022 and beyond, supported by the U.S. Infrastructure Investment and Jobs Act,” Umpleby said.

The first-quarter report states that sales in Latin America increased by 60% as overall construction and mining activities supported higher demand. However, continued growth could be impacted by inflation and interest rate policy decisions later in 2022.

“In Europe, Africa and the Middle East, (EAME), despite the broader geopolitical concerns, we remain cautiously optimistic due to housing growth in the EU investment package that is expected to drive construction demand,” said Umpleby. Within that region, sales reportedly increased 18%, due primarily to residential construction demand.

Through the Caterpillar Foundation the company has donated more than $1 million to support both urgent and long-term needs of the Ukraine humanitarian crisis. Cat suspended operations at its Russian manufacturing facilities.

Conversely, with reduced sales in China, Cat’s Asian Pacific sales decreased by 21%. The 10-ton and above excavator market in China was strong in 2020 and 2021. Umpleby said they are anticipating the market to be slightly lower than 2019 levels, while the remainder of the Asia Pacific region is expected to grow due to higher infrastructure spending.

Operations

Operating profit margins were 13.7% in the first quarter of 2022, which was lower than the first quarter of 2021.

“We expected comparisons would be difficult as inflationary impact to manufacturing costs accelerated in the back half of 2021 and remains at a similar level in the first quarter of 2022,” said Umpleby.

On a sequential basis, margins improved versus the fourth quarter. He said Cat’s first-quarter 2022 profit per share was $2.86, compared with first-quarter 2021 profit per share of $2.77. Adjusted profit per share in the first quarter of 2022 was $2.88, compared with first-quarter 2021 adjusted profit per share of $2.87. Adjusted profit per share for both quarters excluded restructuring costs.

Bonfield noted that Cat is not anticipating a typical year on margins in 2022.

“In a normal year we’d see strong margins in the first quarter with margins decreasing sequentially through the fourth quarter,” he said. “This year we expect margins to improve in the second half of the year compared to both the first half and the comparable period of 2021 as the impact of price actions accelerate.”

Generally, price increases are anticipated to continue to offset manufacturing costs throughout the year, with margins being close to or higher than 2021 in the construction industry segment.

Cat Financial

Cat Financial reported first-quarter 2022 revenues of $652 million, an increase of $13 million, or 2%, compared with the first quarter of 2021. First-quarter 2022 profit was $143 million, a $3 million, or 2%, increase from the first quarter of 2021.

The increase in revenues was primarily due to a $36 million favorable impact from returned or repossessed equipment, partially offset by a $29 million unfavorable impact from lower average financing rates.

Cat Financial says during the first quarter of 2022, retail new business volume was $2.78 billion, a decrease of $30 million, or 1%, from the first quarter of 2021. The decrease was primarily driven by lower volume in Asia/Pacific and Europe, Africa and the Middle East partially offset by increases in North America and Latin America.

At the end of the first quarter of 2022, past dues were 2.05%, compared with 2.90% at the end of the first quarter of 2021 and 1.95% at the end of 2021. The decrease in past dues was mostly driven by the North America, Caterpillar Power Finance and EAME portfolios.

Write-offs, net of recoveries, were $8 million for the first quarter of 2022, compared with $24 million for the first quarter of 2021. As of March 31, 2022, the allowance for credit losses totaled $357 million, or 1.29% of finance receivables, compared with $337 million, or 1.22% of finance receivables at December 31, 2021. The increase in allowance for credit losses included a higher reserve for the Russia and Ukraine portfolios.

“The Cat Financial team continues to focus on execution of our strategy and supporting our customers with financial services solutions,” said Dave Walton, president of Cat Financial. “With strong portfolio health, we continue to deliver solid operational results.”