Construction contractors and equipment managers remain cautiously optimistic about 2023, with solid contracts and certainty on their equipment purchase and rental plans for the year, according to EquipmentWatch’s second annual State of the Construction Equipment Economy report.

However, the tug-and-pull of volatility and uncertainty throughout the economy means that equipment managers must watch their bottom lines with even more vigilance.

Findings in the report are based on various surveys conducted, an in-depth review of EquipmentWatch customers’ fleets, ongoing analysis of valuation and used market trends, and insights based on an understanding of how broader trends in the construction industry impact equipment owners and operators.

Many contractors reported that decisions on whether to retain equipment have become more vital as construction spending remains relatively strong. Through the pandemic, equipment managers have been hanging on to equipment longer due to the ongoing supply-chain issues with new models. This retention continues to drive values up at auction.

Below is a quick review of EquipmentWatch’s report about buying, selling and rental habits. The full report can be downloaded here.

What they faced

A mid-2022 survey of construction equipment manufacturers suggests that while supply-chain issues have been reduced, it is still a strain to meet the demand for new equipment. Contractors are expected to continue with planned purchases in 2023 but will also be delayed as they were in 2022.

EquipmentWatch states that the rental channel is also likely to continue to be strained in 2023.

Due to the ongoing supply-chain issues, 2023 could present an opportunity to sell underutilized equipment. The surveys indicate that 71% of equipment owners intend on acquiring used equipment in the next 12 months. EquipmentWatch

EquipmentWatch

Buy and sell

Most equipment owners have purchased equipment over the past year but perhaps in a more conservative manner than usual.

According to the report, only 14% of those surveyed did not purchase equipment over the past 12 months. More than a third of contractors, 35%, stayed on a plan in terms of equipment purchases in 2022. The same number acquired less new equipment than planned.

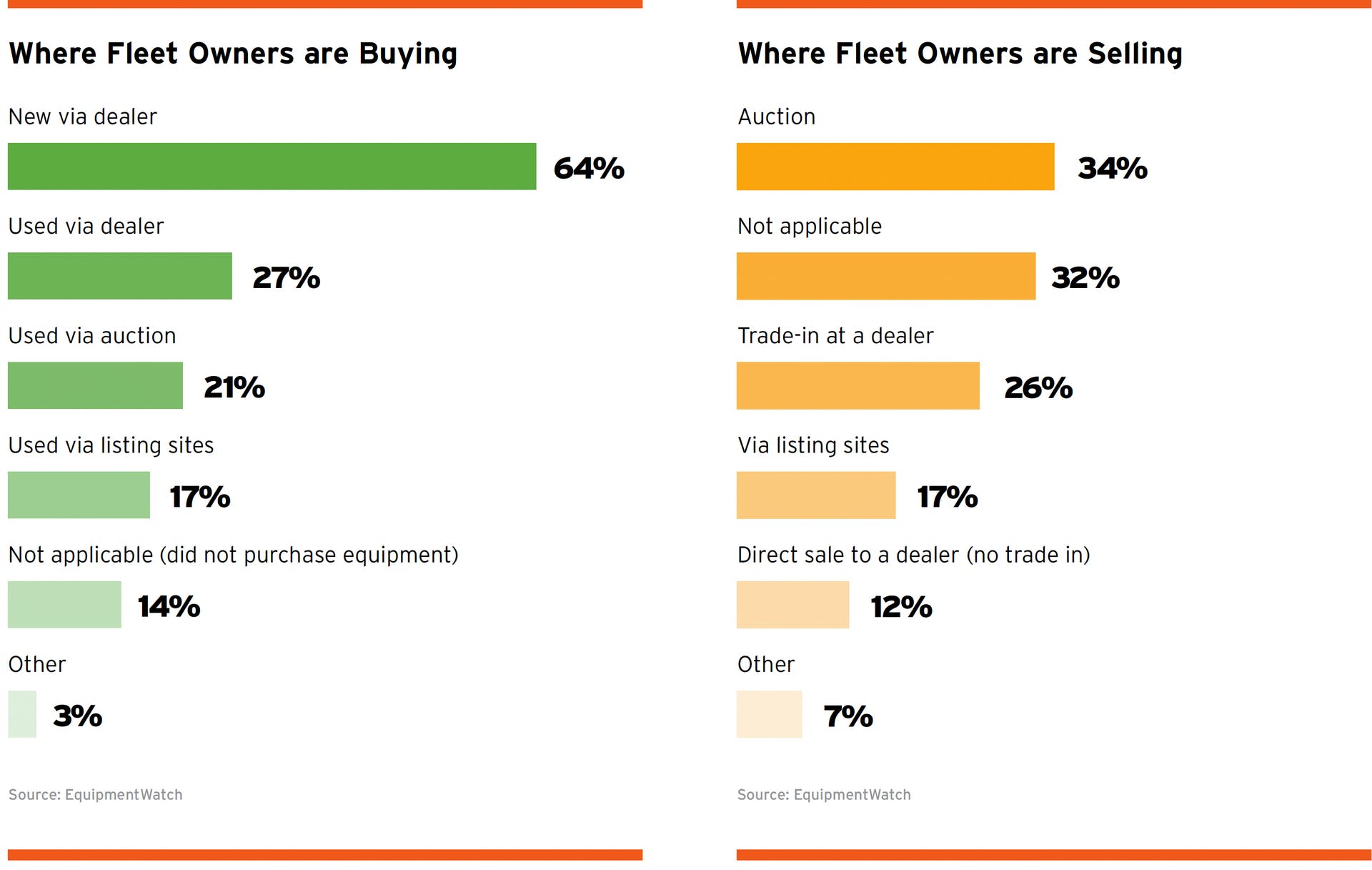

EquipmentWatch analysts found that construction firms use a variety of channels to purchase new and used equipment. Nearly two-thirds of respondents indicated a preference for buying a new machine from heavy-equipment dealers. Another 27% favored acquiring used equipment via a dealer. Other options for used equipment included auctions or used-equipment online listings.

According to the report, only about 3% of equipment owners are looking to alternative means of equipment acquisition, such as private sellers or even direct from a manufacturer.

Based on the survey results, most equipment owners plan on maintaining a solid level of new or used equipment purchases in 2023.

Nearly half of contractors surveyed anticipate buying the same amount of new or used equipment as they did in 2022. Another one-fourth plans on increasing purchases, and 15% are planning fewer new or used equipment acquisitions.

As for selling their used equipment, EquipmentWatch found that twice as many equipment owners said they would be increasing their activity as opposed to decreasing it.

According to the report, contractors looking to sell their equipment are bypassing the option to trade in through the dealer and taking advantage of the strong used market. Nearly 60% of contractors surveyed indicated they were pursuing that route, primarily through auctions.

However, only about a third of equipment owners have sold any equipment in 2022, a significant increase from only 18% in 2021. Analysis suggests this is likely based on the continued impact of the economic volatility and the desire of contractors to retain equipment to complete projects.

Rental intentions

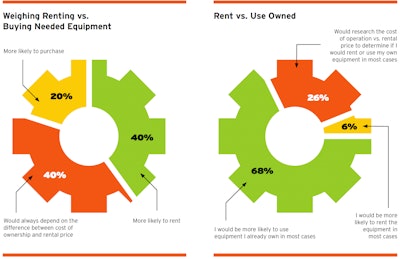

In 2023, the report states, most equipment owners plan on maintaining their status quo when it comes to equipment rentals. More than two-thirds (68%) plan to continue renting at the same frequency. Roughly 21% plan to rent equipment more frequently, while 12% plan to rent less frequently.

Several reasons why construction firms will be renting more frequently are cited in the report. These include general project execution, having more jobs that require additional equipment, and taking on quick turn-around projects that require equipment on short notice. Almost a quarter of the contractors cited the need for new types of equipment that they don’t currently use.

Through its analysis, EquipmentWatch found that contractors are also driven by their return on investment (ROI) goals. Depending on financial situations, the numbers are pushing contractors either to rent more or start owning equipment in 2023.

For some contractors, there remains a competitive advantage for owning equipment in the face of scarcity in their local rental market, while others find renting is more financially beneficial.

Fleet composition

Of the nine core construction equipment types analyzed by EquipmentWatch in the report, six are most often found in owners’ fleets. Among the more prevalent pieces of equipment are trucks, excavators, loaders and graders.

The more applicable a piece of equipment, the more likely at least 30% of a fleet consists of it. Conversely, the report states that the more specialized equipment, such as cranes or drilling equipment, is more likely to not be part of a fleet.

Based on the survey results, EquipmentWatch found that most contractors are managing diverse fleets that are not skewed heavily toward one type of equipment or another.

The report delves further into detail on the brand composition of fleets and the most common alternatives they were exploring due to the supply-chain challenges. Most contractors were open to using an alternative brand and found they performed as well or better than the preferred brand.

The report also delves into how OEMs are expanding their product mixes with low or zero-emission machines that are either battery electric, diesel-electric hybrid, or hydrogen and hydrogen fuel cells and where contractors stand on such developments.

Where values stand

EquipmentWatch states in the report that more construction equipment owners are hanging onto equipment longer and buying less equipment than planned due to unpredictable economic times and ongoing supply-chain challenges.

Across the 10 core construction equipment categories, the average fair market value (FMV) in the resale channel was relatively flat this year, rising 0.7% from the previous year. A more substantial gain of 26% was posted in the average forced liquidation value (FLV) in the auction channel. Six of the 10 categories posted FMV gains and seven had FLV gains at auction.

According to EquipmentWatch, while several categories saw increases in resales, the average age of equipment also increased. This included aerial lifts, compactors, drilling equipment, road maintenance equipment and skid steer loaders. The same occurred with road maintenance equipment and trucks at auction.

However, two categories saw FLV dip in the auction channel even as the age was lower. This included compactors and excavators.

The report offers some insight as to the reason for the pockets of odd behavior.

Through its additional product offerings, EquipmentWatch helps customers understand optimal disposition timing, accurately accounting for equipment costs and providing third-party fleet valuations. EquipmentWatch is owned by Randall Reilly, parent of Equipment World.