When you look at the trajectory that both new and used financed compact track loaders have taken over the past 10 years, it’s all been up. No other type of construction machine can boast of straight year-over-year gains on both the new and used side during the past decade.

In 2011, still in the aftermath of the Great Recession, new financed CTLs were sitting at 6,646 units financed, according to EDA data. In 2020, the number had shot up to 43,340 new financed CTLs. The number of used financed units, while less dramatic, still shows a significant upward track, growing from 4,548 units sold in 2011 to 15,450 sold last year.

And new financed CTLs saw their largest year-over-year gain to date between 2019 and 2020, when the number of units sold grew almost 22%. Used financed units saw an even bigger bump during the same period, growing 25%.

For a more recent time slice, tracking financed filings from Feb. 1, 2020 to Jan. 31, 2021, the number of new financed CTLs rose 21% compared with the same period a year ago, and used finance units rose 19%.

Top financed CTL models, brands

Looking at new models that are most popular when it comes to financing, the perennial Kubota SVL75-2 rose to the top with 4,263 units financed between Feb. 1, 2020 and Jan. 31, 2021.

Other new models seeing 3,000-plus units financed during this period include the Cat 259D3 (3,948 units) and Kubota SVL95-2s (3,792 units).

Although CTLs and skid steers are considered “sister” machines – with most CTL manufacturers having first made skid steers and then branching out into CTLs when they became a market force – the market share mix between the two types of machines has some significant differences.

On the skid steer side, as we earlier reported, Bobcat leads the way with 30% of 2020 financed market share, followed by Cat (21%), Deere (15%) and Kubota (14%).

With CTLs (and looking at a time period that’s adjusted by one month), Kubota tops the pack with 25% financed market share, followed by Cat (23%), Bobcat (21%) and Deere (16%).

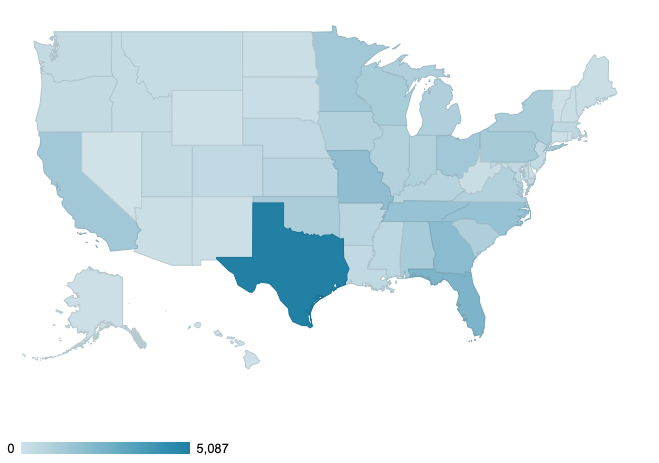

Where buyers are located

Texas again is the demographic giant for CTLs, with almost double the number of purchases of new financed units (5,087) than second-place Florida with 2,344 buyers. Georgia placed third with 1,985 buyers during this period.

On the used financed CTL side, Texas again led the pack with 1,539 buyers, followed by Missouri with 1,188 buyers.

Note: EDA data is compiled from state UCC-1 filings on financed construction equipment. Also note that EDA continually updates this data as information comes in. These numbers were pulled on Apr. 22. While we believe this represents the vast majority of the data, there may be some adjustments going forward.

At auction

As reported by the TopBid auction price guide, 1,331 CTLs were sold at auction from Apr. 1, 2020 to Mar. 31, 2021. The average bid price was $29,122 (just looking at machines that had winning bids of $5,000 and more).

A 2018 Cat 299D2 XHP with 1,436 hours gained the top bid of $82,000. Both the Cat 299D2 and 289D dominated the top price chart, with four of the top 10 models – all low-hour 2019 Cat 289Ds – coming from a Mar. 3rd Ritchie Bros. auction in Denver.

EDA and TopBid are owned by Randall-Reilly, parent of Equipment World.